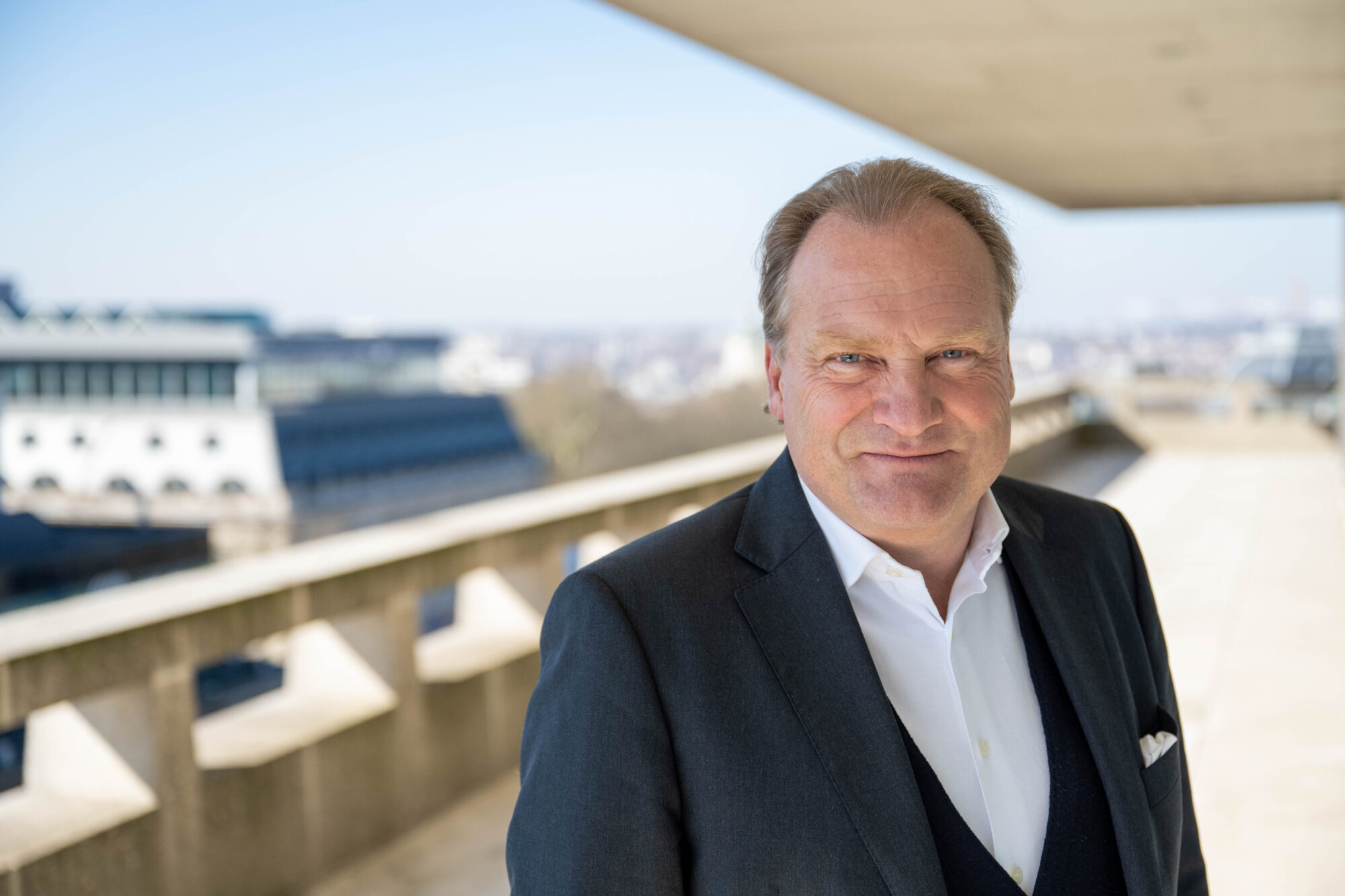

Though companies of all sizes want to reduce their environmental footprint, many lack the tools and support to do so. Guiding and financing the transition to sustainability, banks are an essential link, states Philippe Wallez, ESG director at ING Belgium.

“When it comes to sustainability, every step counts. Everyone has to take action at their own level, within their means”, says Philippe Wallez, Director of Public Affairs & Environment-Social-Governance (ESG) at ING Belgium. “The financial sector has a key role to play, not just in the financial leverage it can provide. It can offer concrete support, accelerating the transition and responding to the requirements of public authorities, particularly the EU.” As pioneer in sustainable finance, the company has chosen to participate in Take the lead in Sustainability Management, a programme developed by the Vlerick Business School and covering all stages of the transition.

“Such a powerful and targeted programme can really make a difference”, says Philippe Wallez. “It includes assessments by experts, partners and consultants familiar with each sector, so that every company knows where it stands and where to start – or continue – on its journey to net zero. Such a transition is obviously done step by step. Regardless of the size of the company, management must first be convinced of the need for the approach, with everything else following on. With ESG needing to become a core element of all operations, it’s not about setting up an ESG team tasked with developing proposals in a back office.” The programme is all about empowerment, where scientifically validated tools and options are proposed to the company which then takes them over and adapts them to its individual situation.

Involving all staff

“ING has joined the Net-Zero Banking Alliance, a United Nations initiative encouraging the financial sector to contribute to achieving carbon neutrality by 2050 and limiting global warming to 1.5°C”, says Peter Adams, CEO of ING Belgium. “Our actions have three main focuses: to reduce our own footprint as a company, to guide our customers to the best of our abilities, and to raise our employee awareness. As part of the latter, we have launched an online training programme on reducing our carbon footprint, the ING Climate School. I myself participated in it and it got my whole family thinking: my two sons are now coming up with ideas to reduce our CO2emissions!”

In 2023, ING will be holding collaborative workshops with ‘The Climate Fresk’ to raise public awareness about climate change. Company employees will also be able to access Sustainability Boost Programmes covering decarbonisation solutions for each line of business.

“We also, of course, offer a wide range of sustainable investments”, Peter Adams goes on to say. “But we go much further, precisely assessing the impact of our corporate lending against the curve needed to achieve net zero. To this end, we have developed a scientific assessment tool called Terra which produces its own annual report.”

“The programme supports companies with hands-on coaching, accelerating their transition to sustainability.”